How does the photovoltaics industry handle business proposals? Companies like to say that the market is very competitive. They’re right, but that’s not the whole story. How much effort do photovoltaics companies really put into winning customers? Three sales-oriented startups – Sellizer, SellWise, and Livespace – researched this topic in Poland and came to surprising conclusions.

Read also

Authors of the Report

Sellizer is a proposal tool that gives users detailed, real-time statistics of the files they send. Thanks to follow-up automation, Sellizer maximizes the chances of proposals being read. The user is notified each time a file is opened so they can contact the recipient right away. Knowing which parts were the most interesting, they can prepare better for a conversation and improve their proposals over time, increasing the chances of winning a sale even nine times.

SellWise provides advice and training in sales and marketing. We help our customers organize their sales practices from A to Z, set up a sales and marketing strategy, implement suitable IT systems and processes, and train the team. Thanks to SellWise, the client can increase their sales without recruiting specialists for every single task.

Livespace has been transforming B2B sales since 2013 by developing a process-focused CRM. Inspired by our own challenges in B2B sales and the lack of adequate tools, we decided to launch our own. Currently, over 800 companies worldwide use award-winning Livespace CRM to increase their sales, streamline their communications, optimize their processes, and achieve more and more ambitious goals.

Patron: fotowoltaikaonline.pl

Table of contents

Why Research the Proposal Process in the Photovoltaics Industry?

We specialize in sales and the proposal process so we never stop researching and analyzing those topics. Our goal is to arm business owners with knowledge that will help them establish or streamline their own operations. We chose the photovoltaics industry because of its prevalence among our clients.

The PV market is one of the fastest-developing renewable energy sectors in Poland. We wanted to see how companies in the industry compete for customers. Are they trying to stand out? How do their proposal processes look like? Do they follow up with their prospects? Our study answers these questions.

A Short Summary

We conducted the study between 8 April 2021 and 10 May 2021.

First, we created a database of PV companies in each region of Poland and those operating nationwide. Then, we analyzed their websites to see if they had contact forms on their homepages and Contact pages. We also noted if there were contact pop-ups on their homepages.

Using email, we sent a request for proposal to each of these companies. We proceeded to answer any follow-up questions and collect data about the messages we received. We also noted any attempts to contact us by phone.

The goal of the study was to collect data about the proposal process in the highly competitive, constantly developing industry of photovoltaics. To learn about the quality of customer service and acquisition, we measured the average response time, analyzed the proposals, and noted any attempts to follow up.

Stage I: Collecting Data

First, we created our database of PV companies using Google search and a website that helps customers find PV suppliers in their neighborhoods (fotowoltaikaonline.pl). Overall, we collected 204 companies from 16 regions and nationwide.

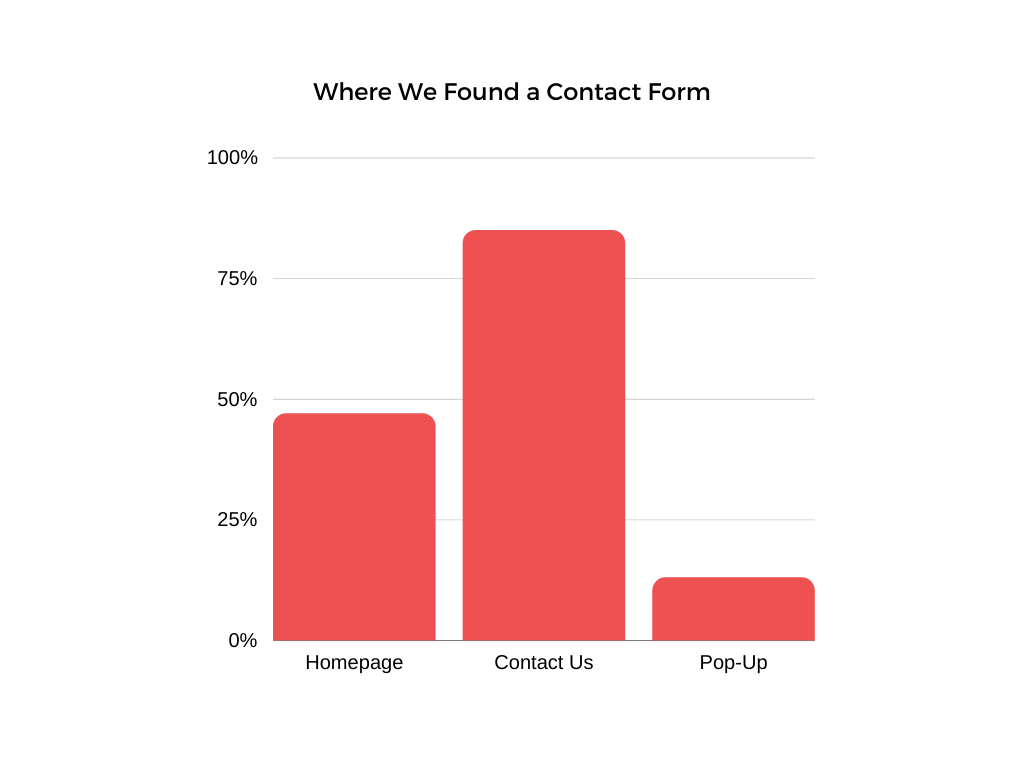

Next, we checked their websites for contact forms on homepages and Contact pages because they make getting in touch with a company much easier for potential customers. We found a contact form on 47% of homepages and 85% of Contact pages.

Apart from that, we noted contact pop-ups on the homepage – a solution that makes it quicker to get in touch with a company for those who prefer phone calls. All the customer needs to do is leave their phone number and wait for a representative to contact them. Only 13% of the homepages we analyzed had a contact pop-up.

Website visitors make quick decisions. If a potential customer doesn’t see a reason to get in touch and a quick method of doing so, they’ll probably give up and move on to the next company.

— Szymon Negacz, SellWise

Stage II: Reaching Out

Our next step was reaching out to all the companies by email. We automated this process with Sellizer. Our messages included basic information such as:

- energy consumption,

- house surface area,

- number of people in the household,

- roofing material.

We asked the companies to send us a proposal and gave them our phone numbers to see how popular this method of communication would be.

Stage III: RFP Response Monitoring

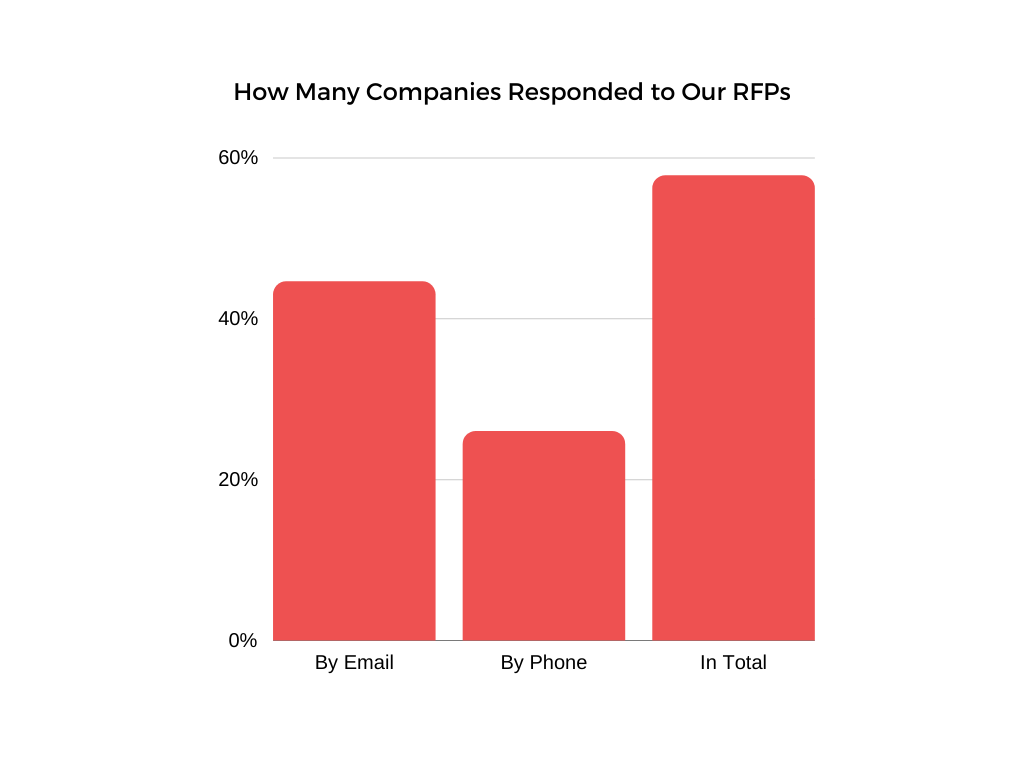

We monitored the responses to our requests, the time we received them, and the preferred communication channels. For 204 emails sent, we received 91 responses (44.6%). The response time varied. Most of the companies who did reply managed to do it within 24 hours (67%). 20.9% got in touch within one hour, and 25.3% took between 1 and 7 days to reply.

The quicker you contact a potential customer, the more likely they are to choose your services. It’s essential to be able to set auto-reminders about tasks in your CRM. Thanks to them, none of your customers will be left without an answer.

— Livespace

If you have doubts, it’s quickest to contact the prospect by phone. If you get all the necessary information immediately, you’ll be able to send the proposal faster, which can be a deciding factor in winning the customer.

We received phone calls from 26% of the companies we contacted. About a half (50.9%) of those only called us once. 28.3% tried again, and 17% called three times. One company wouldn’t give up – their salesperson called 26 times! Still, email remains more popular as a channel of communication.

To add it up, 57.8% of the firms responded to our contact. 39.8% of those didn’t send a proposal despite our request. 60.2% did – most of them immediately (64.8%), while others asked follow-up questions first (35.2%). The questions were mainly about the exact addresses of the houses, roof position, shading, and yearly consumption of energy.

Proposal Delivery Time

How long did the companies take to send their proposals? We measured it from the moment we sent our request or from the moment we replied to their questions if they had any. 52.1% delivered their proposals within 24 hours, and 32.4% took between 1 and 5 days. 15.5% left us waiting for longer than 5 days.

Photovoltaics companies often tell us about how competitive the industry is. This part of our study shows that it’s easy to stand out even in such an overcrowded market – let time be in your favor. The customer in front of his computer will always compare offers to the first company that reached out and served him.

— Szymon Negacz, SellWise

It’s worth implementing a process in your company that will guarantee the prospect contact within 10 minutes (usually it requires a separate team), preferably on the phone, to decide if they’re a good fit and discuss further steps. Then, do your best to send the proposal as soon as possible.

Stage IV: Proposal Analysis

Numbers

In this stage, we analyzed the proposal emails we received. 91.6% of them contained attachments – usually PDFs. Some contained JPGs, PNGs, and videos. 35.2% had only the proposal attached, while 32.4% contained 1-2 additional files and 25.4% – between 3 and 6. Such files included company presentations, product cards, informational flyers, certificates, and credentials.

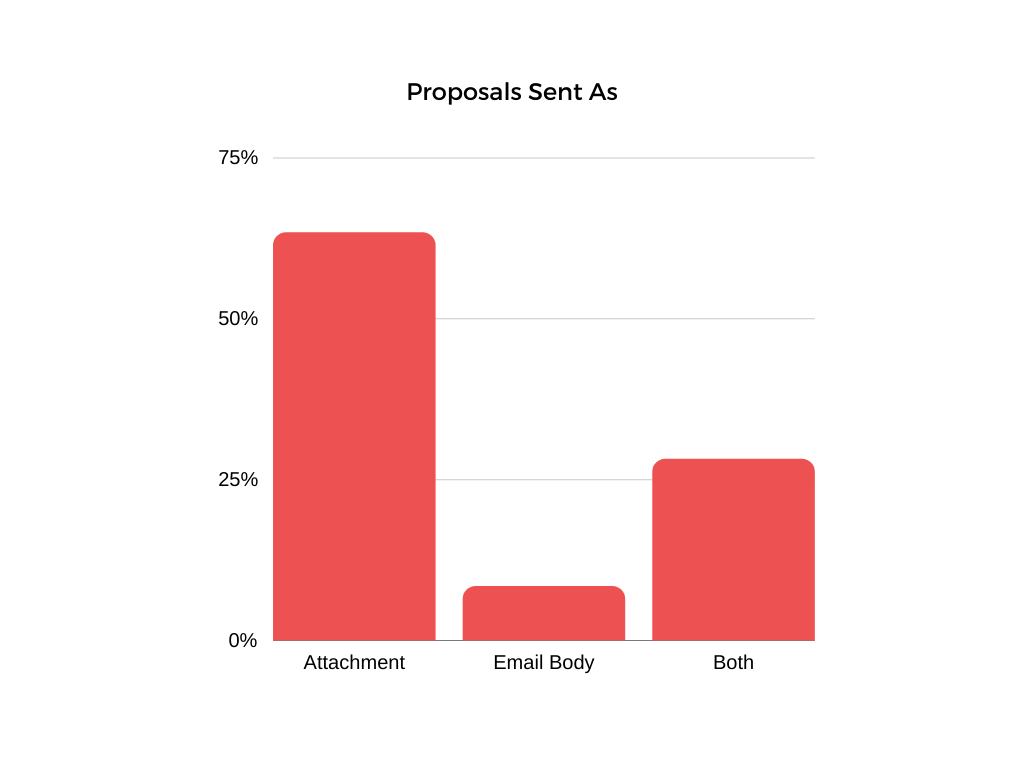

28.17% of firms attached their proposals in PDFs and also laid them out in the email body. 63.38% sent rather general messages, with the actual proposal in the attachment. 8.4% of the companies wrote their proposals in the email body without attachments.

29.6% of the attached proposals were 1-2 pages long, and 28.2% – 3 to 5 pages. 18.3% spanned over 6 to 8 pages, and 7% were even longer.

What’s more, we received more than one version of a proposal from 15.5% of the companies. They usually quoted us for two possible PV installations with different capacities.

Choosing a suitable PV installation is challenging. You need to consider many factors, such as the exact model of the panels or the inverter. A proposal should explain to the customer why a given set and company are the right choice. Usually, the person you talk to isn’t the only decision-maker, so your proposal should contain everything needed to make the decision.

— Szymon Negacz, SellWise

To increase the likelihood of purchase, it’s also worth providing 2-3 options and explaining their advantages and disadvantages. Only 15.5% of PV companies do it, so it’s a good way to stand out.

Content

Personalization

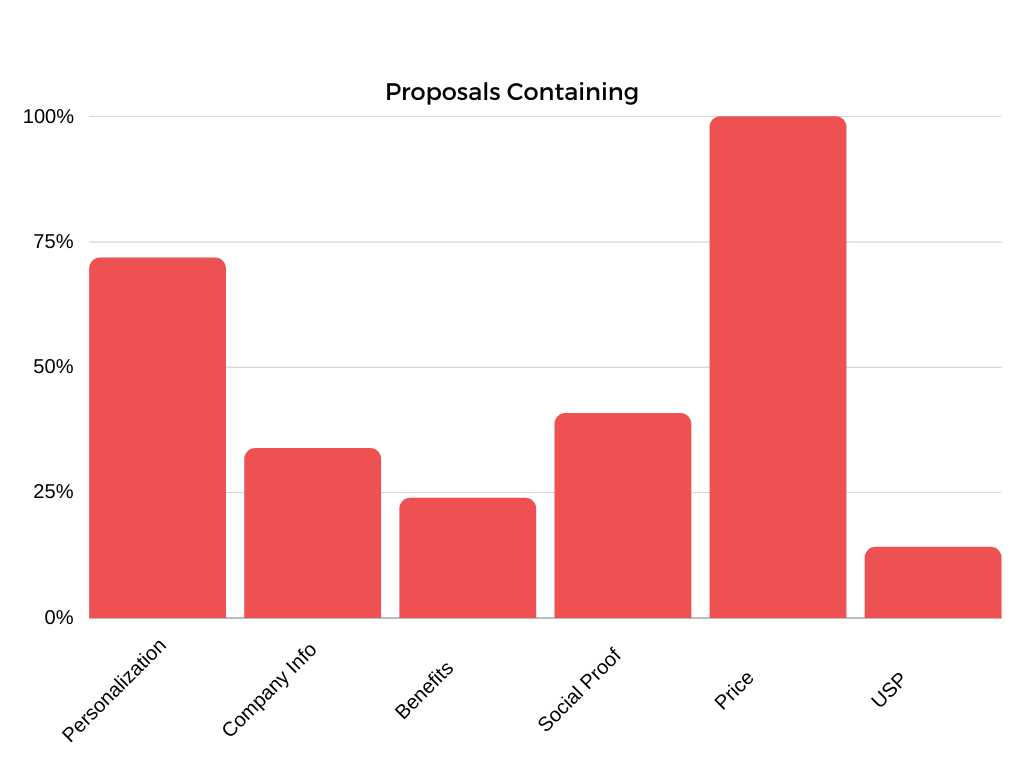

Each business proposal should be personalized so that the recipient knows it was made for them specifically, not copied and sent to every customer. Using the recipient’s name is the absolute minimum. We decided to check for personalization in the proposals we received. 71.8% passed the test, and 28.2% didn’t even contain our names.

Information About the Company

Another thing we looked for in the proposals was information about the company. Customers won’t research all firms thoroughly before contacting them. They expect the proposal to tell them the basics, including how old the company is and its specialty. Only 33.8% of the proposals we got contained this kind of information.

Language of Benefits

It’s critical for a proposal to communicate the benefits of using the given product or solution. Describing it, you should put the customer and their needs in the center. What’s in it for them? Is it a good investment? In photovoltaics, it’s essential to tell the customer how soon they can expect a return on the investment. In our study, only 23.9% of companies explained the benefits of installing a PV system in their proposals.

Social Proof

Business proposals should contain proof of the company’s competencies or product quality. It’s worth including numbers, testimonials, and other evidence that the customer is in good hands. 40.8% of the proposals we received contained social proof, e.g., customer reviews or calculations proving the installation’s efficiency.

Price

It may be obvious, but the recipient should always know what they gain and for what price. Fortunately, all the proposals sent to us contained the exact cost of a PV installation.

Unique Selling Proposition (USP)

The photovoltaics industry is growing fast, and the competition is high. We paid attention to the presence of a USP in the proposals. It’s an answer to questions such as: why should the customer choose you? What makes you different? Only 14.1% of the files we analyzed contained a USP.

Stage V: Follow-Ups

When it came to follow-ups, there wasn’t much to note. Only three companies decided to send another email (after 3, 14, and 19 days respectively). Two others followed up with a text message. One company did it twice – on the same day they sent the proposal and five days later. That means 4.2% of the studied companies followed up by email, and 2.8% did it by SMS.

Waiting for the customer to reach out to you can lead to a situation where he chooses another company that showed him more care (i.e., called him one more time). Following up after sending a proposal is a fundamental part of a well-designed sales process. It means you serve your customers better and get to do more business. Simply put, you make more money.

— Livespace

Yet another area of our report shows how important it is to make your sales a process. Sending proposals without thinking about how to follow up with customers is a massive waste of potential. In the PV industry, it’s worth following up after 24 hours of sending the proposal. Don’t ask the customer if they’ve read it (you might want to use Sellizer to find out). The best question to ask is: “What are your conclusions after reading the proposal I sent you yesterday?”

— Szymon Negacz, SellWise

Conclusions

Response Rate

The response rate of 57.8% was quite alarming. It might be caused by the companies having lots of orders and not looking for more. However, a complete lack of response is a sign of disregard for customers and affects the company’s reputation in a bad way.

Response Time

67% of responses coming within 24 hours is a satisfactory result. Fewer messages were sent after more than a week. Nevertheless, if a customer reaches out to several companies, they’ll likely choose the one to reply first.

Contact by Phone

26% of studied companies decided to call. We conclude that salespeople opt for email more often because it’s faster and allows them to deliver the information in writing, which is more convenient.

Follow-Up Questions

35.2% of studied companies asked additional questions before sending a proposal. It might mean that they were more customer-oriented and wanted to personalize their offer better.

Proposal Delivery Time

Over 52.2% of studied companies sent their proposal within 24 hours. We took into account that it takes work, but we decided that over five days of waiting was too long. That was the case for 15.5% of companies. What’s more, two proposals were sent after more than 20 days.

Proposal Format

8.45% of studied companies wrote their proposals in the email body. In our opinion, this format wasn’t clear and attractive enough. Usually, it wasn’t characteristic of a good proposal and mainly concerned the price.

We found proposals attached in a PDF and described in the email to be the most understandable. Those constituted 28.17% of all proposals. Most (63.38%) were sent as attachments, while the email explained individual issues or possible ambiguities, which was also clear and understandable.

Number Of Attachments

As many as 35.2% of studied companies didn’t attach anything but the proposal to their emails. Usually, they lacked detail and didn’t provide much information besides the price (e.g., a description of the company, the benefits, or social proof). They seemed to have been prepared at short notice and weren’t persuasive.

Some messages did contain attachments (1 or 2 in 32.4% of the cases), which helped with a broader understanding of the proposal.

Content

71.8% of proposals were personalized (even with just our names), which is not enough. 33.8% contained information about the company, which is a low result as firms should strive to show themselves in a good light.

Only 23.9% of companies explained the benefits of installing a PV system, which is crucial – customers want to know how the product or service will meet their needs.

More (40.8%) proposals contained proof of value. We believe it should always be included, just like USP, which we found in only 14.1% of the files. In a highly competitive industry, a USP is how you gain an advantage.

Follow-Ups

We received only 6 follow-ups from 5 companies, which surprised us in a bad way. Why? 80% of sales require 5 follow-ups to come to a close, while 44% of salespeople give up after one try (source.) In our case, it was worse – only 7% of the firms that had sent us a proposal decided to follow up. 80% gave up after the first contact. How can they expect to sell, then?

The Summary

When we chose the photovoltaics industry for our study, we were thinking of the rapidly growing market and high competition. As it turned out, we were pretty disappointed. We assumed that the ‘battle’ for customers would be more noticeable.

In reality, the response time wasn’t always quick (in 42.2% of cases, they didn’t reply at all). We waited for the all-important follow-ups in vain – we received only 6.

The proposals themselves were mediocre. There were some good ones with all the desired elements, but many were about the price only. We noticed a lack of value proposition and proof to support it. We hoped for USP, which is vital in competitive industries, but most proposals didn’t deliver that.

A fast-growing industry gives you plenty of opportunities to outrun the competition. We hope that this report has given you the knowledge to optimize your business and gain an advantage over other photovoltaics companies. Good luck!

— Livespace

This is a translation from Polish. The original report can be found here: https://offer.sellizer.io/Ubz8EX3iZ